Seeing a trend play out in real time isn’t always easy. But sometimes it stares you straight in the face begging you to have the courage to act.

March 3, 2025 brought one of those trends right out into the open. All you had to do was look at the clues.

That day, President Trump addressed Congress. At one point during his speech, he put on his real estate hat saying, “I think we’re going to get it – one way or the other, we’re going to get it.”

He was talking about buying Greenland.

It wasn’t the first time he said something outrageous. And it won’t be the last.

He went on to say “We will keep you safe. We will make you rich. And together, we will take Greenland to heights like you have never thought possible before.”

MGGA: Make Greenland Great Again.

It also wasn’t the first time he mentioned Greenland as an acquisition target for the U.S. It all started in 2019 during his first term as President. Except this time, he ramped up his efforts saying it’s “an absolute necessity.”

Greenland is the largest non-continental island on the planet. At more than 830,000 square miles, it’s more than a quarter of the size of the continental U.S. Yet it only has a population of 56,500 people.

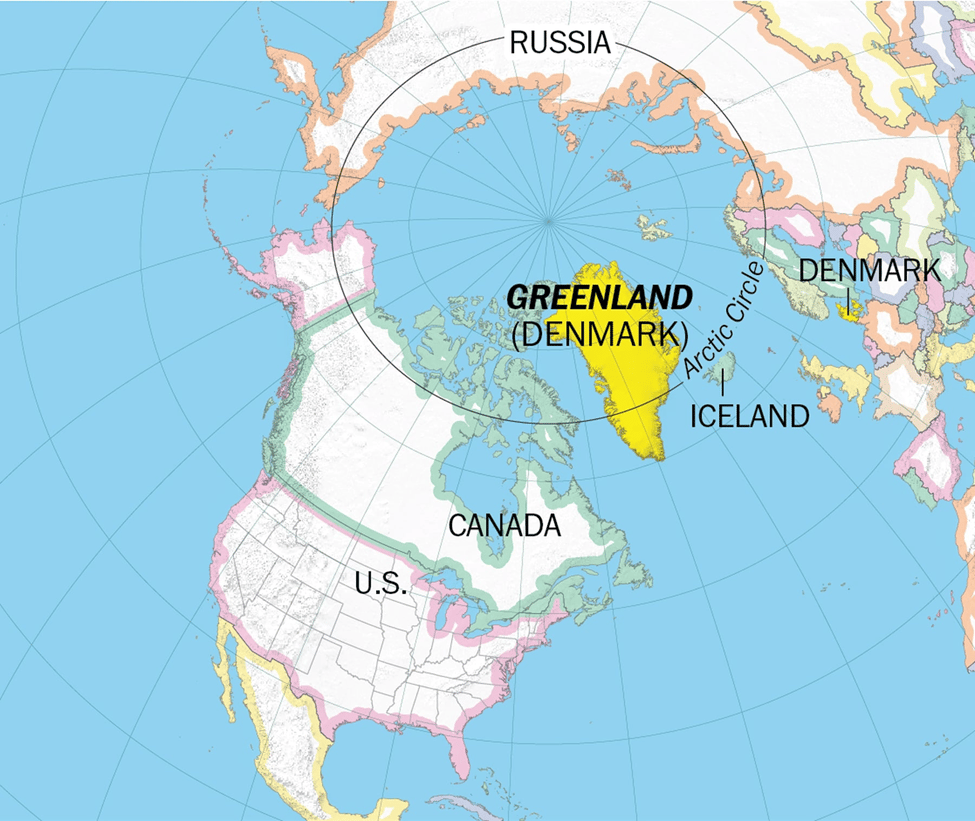

Part of the reason President Trump wants to bring Greenland under U.S. control is because it sits between North America and Russia. It’s the shortest route for a potential ballistic missile launching from Russia to the U.S. And it’s a gateway to the Atlantic Ocean for Russia’s Northern Fleet.

Source: The Washington Post

That’s why the U.S. maintains a military presence on the island at the Pituffik Space Base. It’s part of a deal that the U.S. has with Denmark, which currently controls Greenland.

But it’s far more than just a military outpost. Greenland is rich in resources. Very rich.

That includes critical metals. The island holds at least 43 of the 50 critical minerals listed as vital to national security by the U.S. Geological Survey (USGS). Like copper, graphite, lithium, silicon and more importantly, rare earths.

Regardless of what you think about President Trump’s Greenland comments, one thing’s for certain: he’s going full-force into the critical metals space. He’s signed at least four executive orders dealing with critical metals.

That includes his March 20th order entitled “Immediate Measures to Increase American Mineral Production.” The goal is to create an entire in-house supply chain of critical metals to reduce reliance on foreign sources.

More specifically, China. Which the U.S. depends on for 30 critical metals. And which controls close to 90% of the rare earth market.

This specific executive order authorizes the use of the Defense Production Act (DPA) for critical minerals. That means the U.S. is at war… at least when it comes to mining.

A Critical Trade

Fast forward to today and the critical metals space is heating up.

In July, we saw the first real sign of the White House’s critical metals agenda moving forward. That’s when the Department of Defense (DoD) announced a massive investment into MP Materials (MP).

MP owns the Mountain Pass rare earth mine. It accounts for about 11% of world rare earth production.

Mountain Pass Mine, Source: MP Materials

The company also owns a small rare earth magnet production facility in Texas.

Rare earths – and rare earth magnets – are critical to defense applications. Consider that an F-35 – one of the most advanced fighter jets in the world – needs around 900 pounds of rare earth metals. And the Virginia class nuclear submarine needs about 9,000 pounds.

Without rare earths, they’re toast.

So the DOD agreed to invest $400 million into MP for a 15% equity stake. That makes it the company’s largest shareholder.

Since that announcement in July, shares of MP are up around 130%.

Then news broke last week of the second sign of the Trump administration’s critical metals agenda. That’s when it announced it’s looking to buy an equity stake in Lithium Americas (LAC).

LAC owns the Thacker Pass lithium mine project in Nevada. It’s currently negotiating a $2.2 billion loan from the Department of Energy to build that mine. A project that the White House supports.

So when news broke that the government is looking at a potential equity stake, shares took off. They’re up more around 80% since then.

But it’s more than that. It has speculators questioning: who’s next? And it’s lifting the entire sector.

This is a trend that premium members of Strategic Trader know all about. We jumped on it earlier this year. And our three recommendations in the space are currently up 376%, 340% and 161% as I write. All in a matter of months.

But if you think you missed the boat, think again.

Trillions Up for Grabs

In the past, permitting a new mine was slow, cumbersome, and costly. That’s changing with the recent Executive Orders. And I believe it’s going to open up a chance to tap into a multi-trillion dollar opportunity.

Since 2002, only three critical metals mines have come online in the U.S. Yet there are 10 non-operational mines currently in various stages of the approval process. And many more new mines looking for approval.

Plus, the U.S. has some of the best mineral reserves in the world. The total estimated value of the U.S. national endowment of select critical mineral reserves and resources is more than $8 trillion.

That just scratches the surface. It’s an opportunity to potentially make many multiples of your money. Turning dimes into dollars. Even if the U.S. doesn’t buy Greenland.

But the key is staying patient. Staying disciplined. And ignoring the short-term noise.

It won’t be easy picking winners. The mining space is notorious for hyping up projects only to see them flame out. Especially in a space like critical metals.

But all it takes is one trade in the mining space to see potential portfolio-altering gains.

Are you ready?

Regards,

Editor, Strategic Trader