In the last issue of the Strategic Edge, I talked about my experience at this year’s CES show in Las Vegas.

I got to see the latest and greatest in tech, from new TVs, new handheld devices and even things the future of gaming. Like the Omni One full-body virtual reality gaming system from Austin, TX based Virtuix.

Omni One VR system

In fact, just this week, Virtuix went public. Which is another benefit of the show. You get to see developments take shape from both public and non-public companies. And in some cases, find ways to invest in those trends or directly into those companies you meet with at the show.

Sometimes even before they go public. (More on that below.)

This year proved again that there are some trends worth watching.

The Robots are Coming

For years, I’ve seen robotics companies showing off their latest innovations at CES. From robots that can play chess, to little robot dogs that are nothing more than a kids toy, these companies always have a footprint at the show.

But this year looked different. It was evident there were far more of them. And they were showing off robots that could do some incredible things.

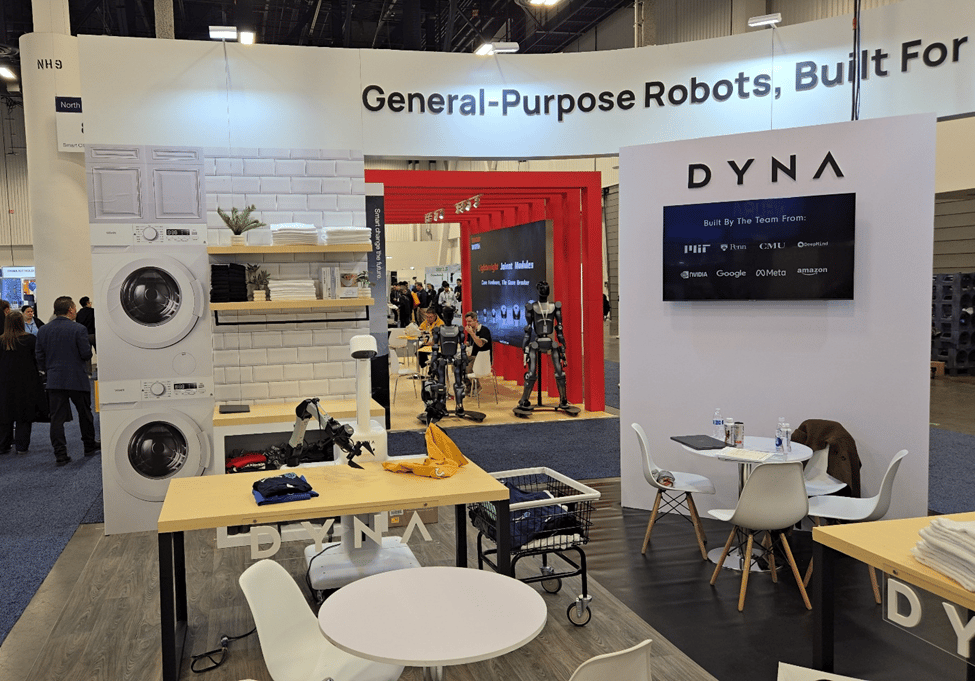

For instance, a robot that could fold laundry. (You can see it in action here.)

Laundry robot

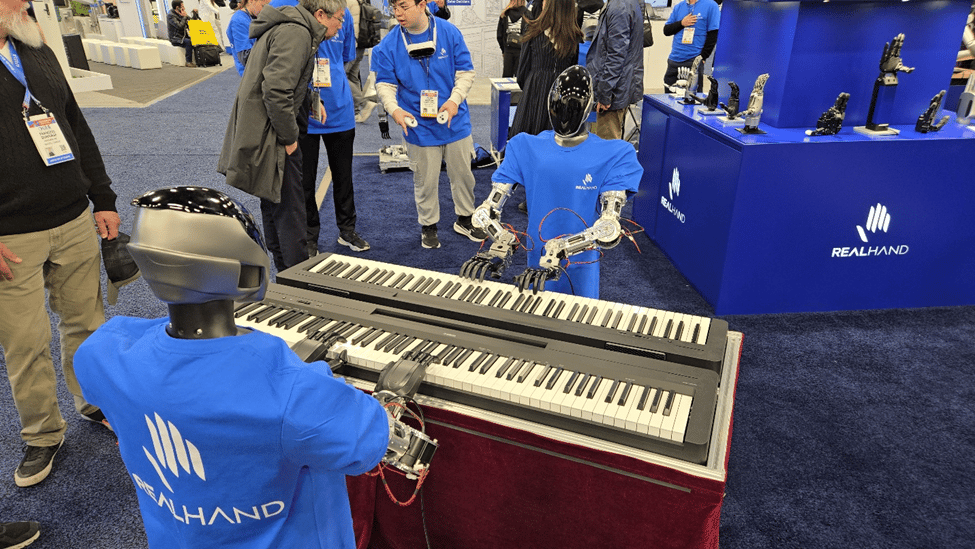

Or the dueling-piano playing robots. (Watch them play here.)

Dueling robots

What’s interesting isn’t so much that they play the piano. It’s that their hands are more human-like than I’ve seen in previous years. So much so that it allows them to do things they couldn’t do in the past.

Not to be outdone, one of my personal favorites was the robot dressed as Michael Jackson dancing to Billie Jean. (Watch it move here.)

Dancing robot

Now, I don’t believe robots are ready to take over. At least not yet.

From what I saw at the show, there’s still a lot of work to do. But it is something to keep an eye on as a future investment theme.

However, that’s not the case with another trend I had a chance to see more of at the show. One Premium members are already benefitting from.

Taking to the Skies

In the December issue of Strategic Trader, we talked about the changing face of warfare. More specifically about drones.

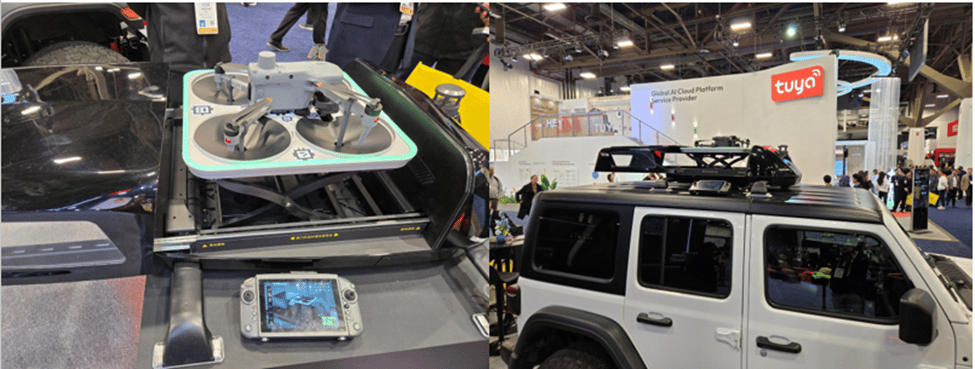

Drones aren’t new. We’ve seen drone use in the military going back nearly 25 years. And recreational drones are everywhere. In fact, this year I even saw how companies are finding new ways to deploy drones, like from the roof of your car.

Rooftop drone

What is new is how different industries are using drones. Including in military operations. More specifically things like drone swarms wreaking havoc across the battlefront. Or companies, like December’s recommendation, that look to counteract those drone swarms. (Which Premium members are already benefitting from with that company’s warrants up triple-digits in just one month.)

But it’s more than just the military. It’s also things like agriculture that are benefitting from drones.

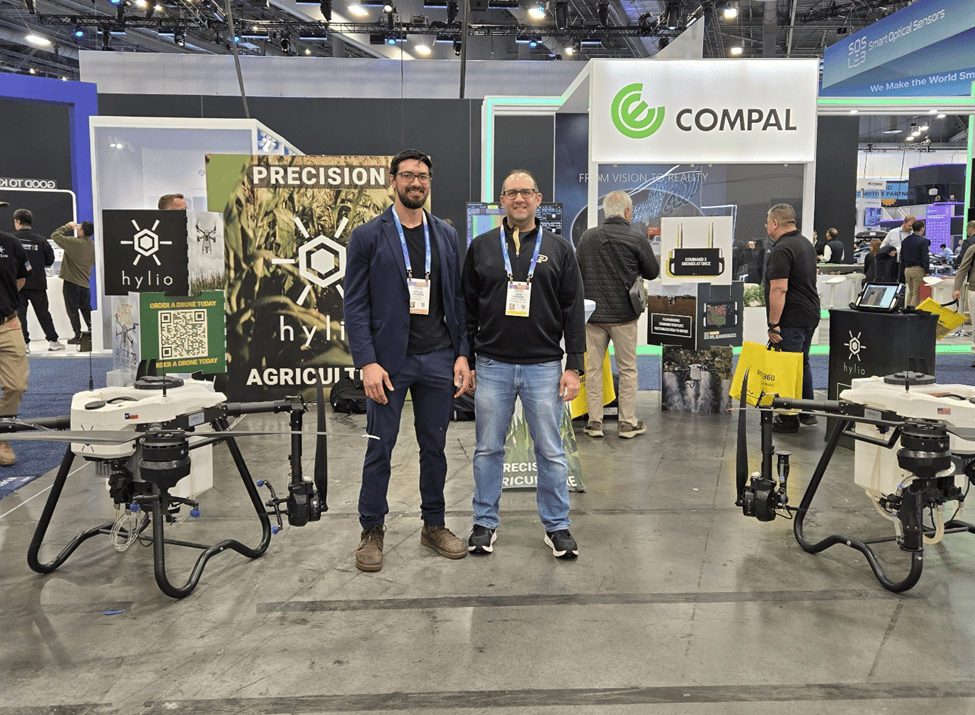

While at the show, I had a chance to speak with Arthur Erickson, the co-founder and CEO of Hylio, a Texas-based agricultural drone company.

With Hylio CEO Arthur Erickson

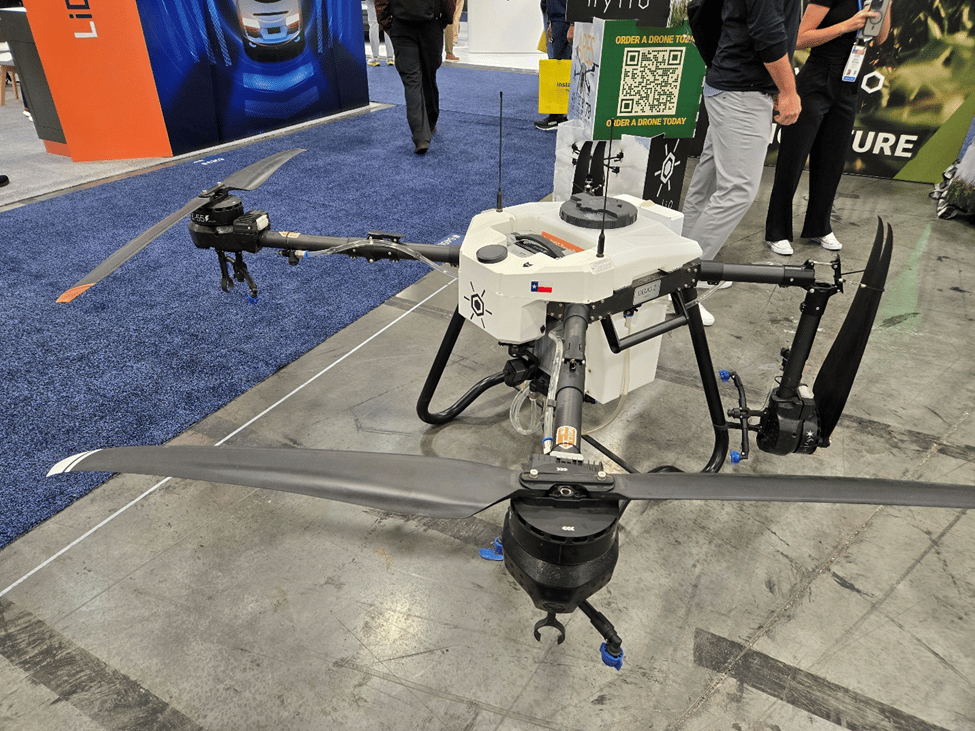

Hylio makes drones that can autonomously deliver a payload of fertilizer to an area of crops. The largest of the company’s drones, the Ares, can hold a payload of up to 110 pounds. It can spray around 70 acres of land per hour.

Hylio agricultural drone

Rather than the traditional way farmers spray their crops, drones don’t trample those crops. There’s no soil compaction. And the drone can deliver a wealth of data about its operation to users.

What’s more, Hylio is the first agricultural drone manufacturer approved by the FAA to operate a “swarm” of drones. All that means is users can operate up to three Hylio drones at a time.

And for the most part, these drones are autonomous. You program in an area to spray and the drone does the work. (The FAA doesn’t yet allow them to be fully hands-free with no user on site. That’s something the company is working on now with the FAA.)

But agriculture is just the first area Hylio decided to focus on. As Arthur told me, the possibilities are nearly endless. Including using drones for things like industrial maintenance. Or, for custom applications.

In fact, Hylio customized one of its drones for a user who wanted to retrofit it for high-rise window washing.

Today, Hylio is seeing more demand. In the company’s most recent fiscal year, it did a little more than $11 million in sales. Up about 35% from the previous year.

It’s why Hylio is currently raising money to scale up its production facility. It only has so much capacity to build new drones. (All of which are American made. Including most parts.)

But demand is clearly there. Which is why the company is currently going through a crowdfunding campaign on Start Engine. (Now keep in mind, Hylio is still a private company. And we’re in no way endorsing or recommending investing in the company’s current capital raise. If you do, please do your own due diligence and understand the risks.)

Now, we believe drones are just one area that haven’t had their real breakout moment from investors and speculators yet. The other happens to be in a similar space.

Uber Air

Many of you may know about Joby Aviation. The company makes electric vertical takeoff-and-landing (eVTOL) aircraft. Basically massive drones but for passengers.

Think of it as a sort of Uber of the skies.

It’s part of a broader trend in aviation that’s slowly trending. In fact, at last year’s CES, I heard from Delta CEO Ed Bastian on how Delta invested in – and is partnering with – Joby to add Joby’s air-taxi service at select locations in the coming years.

That could help fliers get to the airport for a flight far faster than by car or public transit. All for a fee of course.

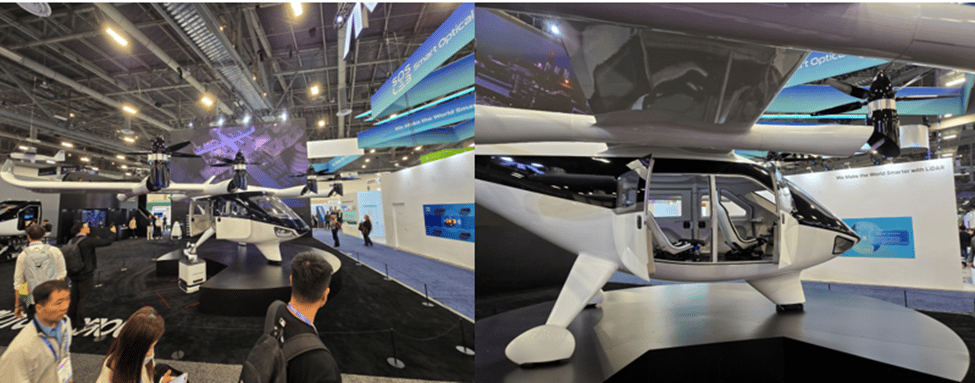

This year saw more eVTOL companies on display at CES.

eVTOL

There were even companies showing off eVTOLs for personal use.

Personal eVTOL

Imagine flying to work in your own personal drone instead of driving.

You take off from your driveway and land directly in a parking spot at the office. No waiting for traffic lights. No weaving through traffic.

Those are the kinds of possibilities coming with eVTOLs. And it may happen faster than you think.

It’s why eVTOLs are another trend that’s catching my eye as a potential breeding ground for speculative money.

Overall, the entire week was an incredible experience. Not only did I see tons of new devices – from talking robots to flying cars to the weird and wild – I also had a chance to talk with company executives and representatives like the ones I mentioned above.

The point is there are a ton of opportunities waiting for the right moment to break out.

Using the knowledge I learned from this year’s CES is helping to light the way on what may come next. And that knowledge may ultimately lead Premium members to more triple-digit or greater winners in the future.

Regards,

Editor, Strategic Trader