It’s one of the most important things we’ll do all year…

Each December, we’ll predict the direction of prices for several key markets in the coming year. We don’t care about the exact price. What we want to determine is the direction, higher or lower.

Getting the direction of a market move right is one of the most important factors in long-term investing success. It can mean getting in before a market takes off. Or making adjustments to your portfolio that may help you outperform.

Our take on the direction of key markets is one of the most valuable things we can share with you. It’s also important that you understand why we value it so much.

When prices in any corner of the market rise, related stocks tend to do well. Even the worst-run companies in a hot sector benefit. That makes stock picking fun.

The same goes for falling markets. People tend to wait too long before rushing for the exits. Even if you’re sure you’ve picked the best stock by all metrics, it’s likely to flop if its industry faces a down market.

However, all down markets are temporary. Over time everything runs in its own cycle. Focusing on the corners of the market heading into upswings and staying away from those on the edge of downswings is a key factor to building substantial wealth in the market over time.

And getting the big picture right today is more important than any time in recent memory.

So over the next several weeks, we’ll give you our predictions of where we believe certain markets are heading.

Today, we’ll start with interest rates.

Interest Rates

Back in August, we talked about how it looked as if the Federal Reserve was about to reverse course. Federal Reserve Chairman Jerome Powell – or J-Pow as we like to call him – signaled his higher-for-longer interest rate policy was about to end while at the annual Jackson Hole Economic Policy Symposium.

And instead of focusing on inflation, the Fed was shifting to focus more on the job market.

In his speech, he talked about the Fed’s “Statement on Longer-Run Goals and Monetary Policy Strategy.” A document the Fed reviews every so often to make adjustments to its strategy.

During his speech, Powell said:

Overall, while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising.

[…] with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.

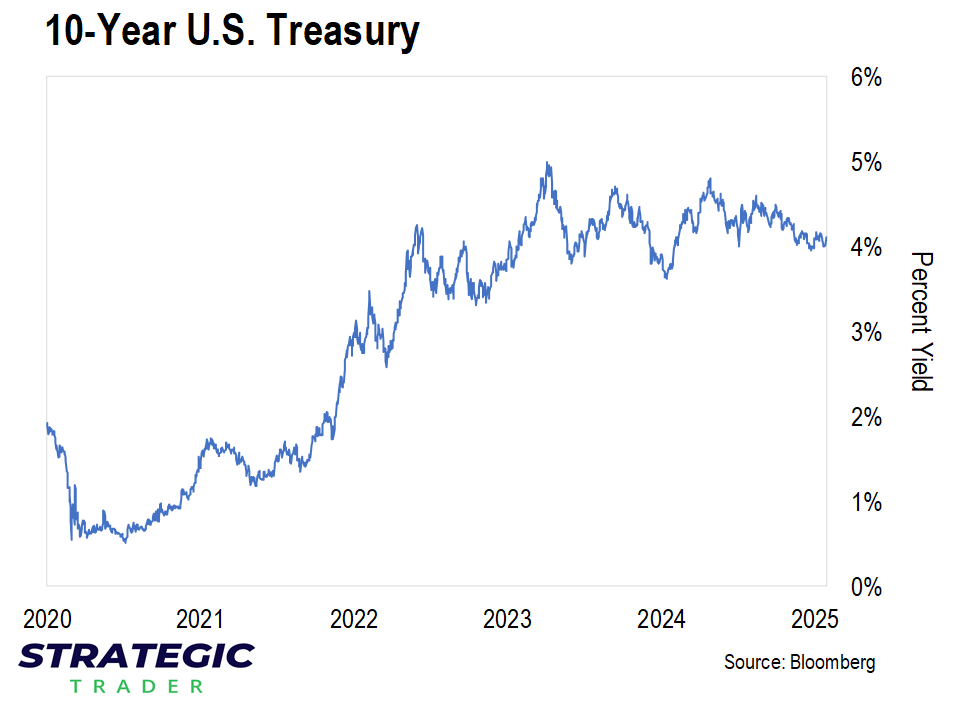

At the time, we said interest rates were almost certainly heading lower. Something that proved to be true not long after.

Since that speech, the Fed lowered its benchmark overnight lending rate twice. Each time by a quarter point. It now stands at 4%, down from its most recent peak of 5.5% a little more than a year ago.

But that may be just the beginning. we expect the Fed to cut rates further with stress showing up in certain areas of the economy. Something we’ll know for sure next week when the Fed releases its decision on Wednesday, December 10.

However, it’s not just the economy affected by interest rates. It’s also the growing national debt pile.

We’ve said for years the U.S. government debt load just about doubles under each 2-term president. Under Reagan, the debt grew 185%. Under George W. Bush it grew 93%. Under Obama, it grew 78%. George H.W. Bush and Clinton together sent it up 111% over a combined 12 years.

And so far between Trump and Biden, the national debt is up 92%.

The problem is the government has to pay interest on this debt. And when it tries to refinance, it can place a massive burden on government finances if rates are much higher. Something we’ve seen happen over the last several years.

This year, the government will have to spend close to $1 trillion on interest payments. That’s nearly double the interest cost of just three years ago. And about the same amount as its military budget.

It’s part of the reason we have President Trump calling for much lower interest rates. The government needs them lower as the interest cost on that debt continues to surge.

It’s also why we know that Trump is showing J-Pow the door when his term as Fed chair expires next year. In his place, we expect the new Fed chair to be more accommodating. Meaning cutting rates even more.

So for 2026, we expect interest rates to head lower.

We’ll track this by using the 10-year U.S. treasury yield as a benchmark.

It sits at 4.09% as we write.

While lower rates might mean a cheaper mortgage in the short run there’s a long term effect you should be aware of. We think the Trump economic team has its eye on it by design. Something we’ll discuss more next week.

Regards,

Editor, Strategic Trader