A 300% gain…in two weeks.

It sounds impossible. Maybe you think it can’t be true.

Or maybe you think you have to take on a massive amount of risk. Or try some crazy, leveraged trading strategy that can wipe you out in a hurry.

You see, what most people don’t realize is speculating in the market is like going to the carnival to play games thinking you’ll come home with the big prize.

First you start at the shooting gallery, but your aim is miraculously “off” that day.

When that doesn’t work, you move onto the next game. Maybe this time you’ll try your hand at the ring toss. Then to throwing darts at underinflated balloons.

This goes on over and over again. You see other people winning. So you jump from game-to-game hoping that it’s your turn next.

The truth is you don’t have to play everyone else’s game. You don’t need to go to the carnival to win big prizes.

Or, if food is your thing, go to the Cheesecake Factory and try everything on the menu.

All you need is one strategy. One thing that – with the right system in place – can churn out enough winners to more than make up for the losers.

Something that can see you earn 300% in two weeks…or even thousands of percent in a matter of months.

The type of game the carnies don’t want you to know about. Or the off-menu item only reserved for those in-the-know.

Drilling for Warrants

Long-time Premium members of Strategic Trader know all about this insider’s game.

It’s how we actually did earn 300% in two weeks speculating in offshore oil drilling company Valaris.

In the January issue of Strategic Trader, I told readers that sometimes the best place to find great ideas is to look around and see what everyone else hates. Then finding a way to play it.

But instead of focusing on what may seem like an easy layup in buying a company’s stock, we go for the open three-pointer that has a greater than 50% chance of going through the back of the net.

Which is exactly what we did with Valaris when I recommended the company’s warrants on January 21.

At the time, I told Premium members that the offshore drilling business was rising from the ashes after years in purgatory.

The fact is that the world wouldn’t survive without offshore oil. According to the EIA, offshore oil production accounts for about 30% of the world’s supply.

But in order to search for oil offshore, you need the right tools. Like the offshore rig pictured below.

Valaris DS-17 Source: Valaris

Valaris happens to be one of the world’s largest offshore rig operators. It owns a fleet of “seventh generation” (7G) drillships, the most advanced in the world. They can pull oil from nearly 10 miles below the surface of the ocean.

Today, there are only about 50 of these 7G drillships in the world. Valaris happens to own 12 of them.

After declaring bankruptcy in 2020, the company emerged with a fresh balance sheet and an eye on the future. And with a world-class fleet, Valaris turned its fortunes around by going from bankruptcy to billions in just a few short years.

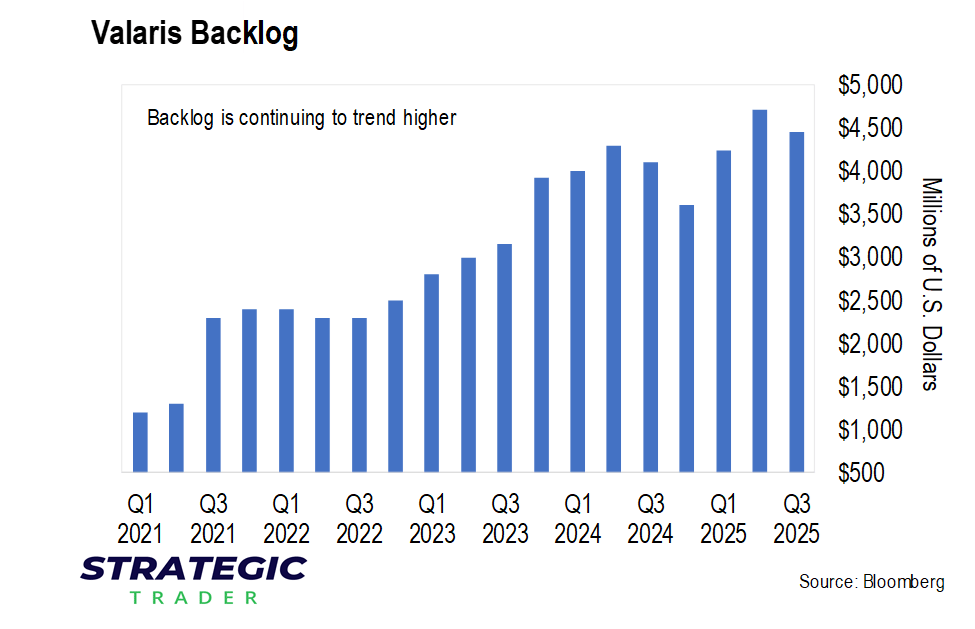

So we made a bet that the company’s fortunes would continue to rise, especially when its backlog – worked booked in the future – kept rising.

But a funny thing is happening in the offshore oil drilling business: new ships aren’t coming online anytime soon. They take years to build and there simply aren’t any on order with shipyards.

And with some ships too old to keep operating, the fleet of drillships is getting smaller.

So earlier this week, offshore drilling giant Transocean (RIG) decided instead of waiting years for a new fleet, it would buy one. More specifically, it’s acquiring Valaris.

Shares of Valaris shot up immediately.

Since I told readers about the company on January 21 through this past Monday’s close when we closed out the trade, shares gained about 53%.

But the warrants crushed that return, gaining 300% over the same period.

Same company. Wildly different result. All by using a system that’s proven itself over the seven years since starting Strategic Trader.

Wash. Rinse. Repeat.

Some of you may be skeptical and think this was a fluke. Maybe we got lucky just this once.

But that’s not at all the case.

In December, I recommended warrants in a little-known drone company, VisionWave, that’s making a system to counter drone swarms. Within weeks, the stock shot up 84%. But the warrants did far better, gaining 202% when I alerted premium members to take some profit.

But those are just two examples of what we’ve done here at Strategic Trader. My Premiums subscribers have had the chance to cash out with 10x or more gains more than half a dozen times over the past seven years. Not to mention the more than two dozen triple-digit gains on other trades.

The fact is I’ve seen this time and time again. I’ve personally made 10x-plus gains numerous times over the years with warrants. And it’s the reason I developed the system that we use today to zero in on this little-known, but lucrative, corner of the market.

The good news is we’re just getting started. So the question isn’t what game are you going to try to play this year to help boost your portfolio. The question is: Why aren’t you trading warrants?

Regards,

Editor, Strategic Trader

P.S. If you’re interested in joining us as we look for our next big warrants winner, click here for a special upgrade offer for the life of your membership.