At the beginning of the month, we kicked off our 2026 prediction series, one of the most important things we’ll do all year.

So far in the series, we’ve covered the direction of interest rates and the U.S. dollar.

We don’t care about the exact price. What we want to determine is if these markets will be higher or lower over the next year. That will help us make adjustments to be in a position to outperform.

In Part I, we said we believe interest rates are heading lower. In part because after a historic rise – with the Federal Reserve increasing rates at the fastest pace in history and keeping them there – we’re entering a new rate-cutting cycle.

We’re tracking that prediction by following the benchmark 10-year U.S. Treasury yield.

Then in Part II, we predicted that the value of the U.S. dollar is also heading lower in the coming year. It’s in part due to our prediction of lower interest rates. And in most cases, the dollar and interest rates tend to head in the same direction.

But it’s also because it’s how President Trump achieves his goal of reshoring American manufacturing. It would be almost impossible to do that without a weaker dollar.

So we expect the U.S. Dollar Index (DXY) to head lower in the coming year.

Getting the direction of interest rates and the U.S. dollar can help setup how we view other markets.

So today, we’ll cover commodities and where we think the overall commodities market is heading in 2026.

Commodities

Commodities are the basis for modern life. They give us the necessary fuel to keep our bodies moving. They heat our homes in the winter and cool them in the summer. They go into every piece of modern equipment that we use from our smartphones to our TVs to anything else you can think of.

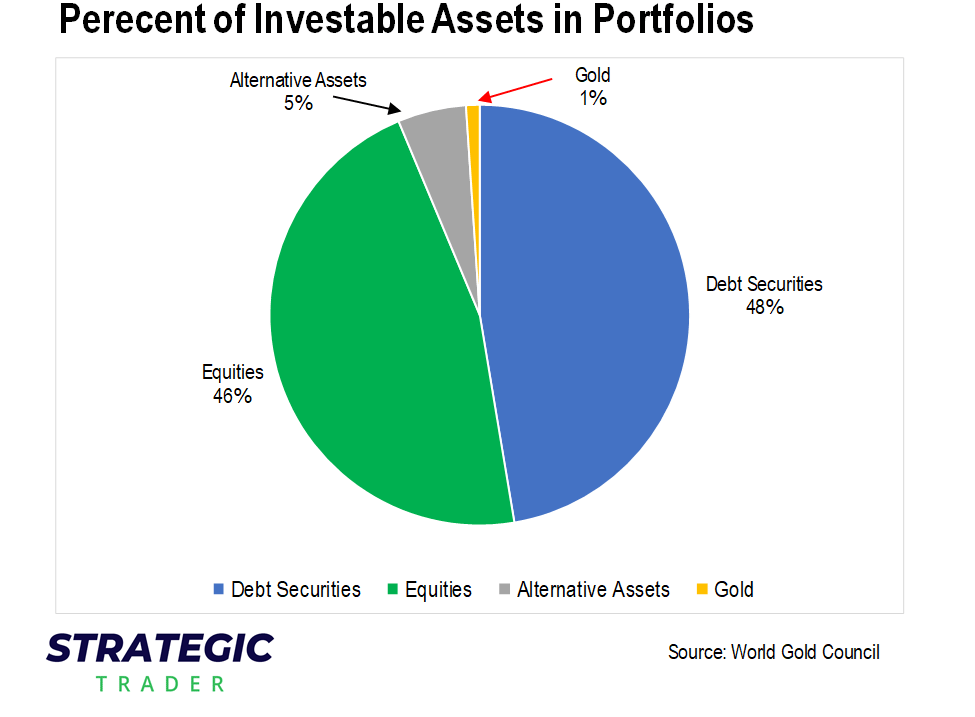

Despite that, ask your average investor if they own commodities in their portfolio and they’ll probably look at you funny. Why would they when all they need to keep their portfolio chugging along are companies like NVIDIA, Tesla, Netflix and other tech darlings.

Those tech darlings have the S&P 500 up 44% over the past three years. Which means even if you just bought an S&P index fund, you’re seeing about 13% compound annual growth since 2022.

So it’s no surprise that most investors wouldn’t even think about commodities today. Even with a chart like this:

Longtime readers know we have a soft spot for gold. We view owning physical gold as a necessity for protecting your hard earned wealth. And we’ve successfully speculated on gold mining companies through both stocks and our favorite speculative tool at Strategic Trader, warrants.

Yet most people we talk to have no idea that the price of gold is outperforming stocks over the past three years. And it’s not even close. Gold is up 142% to the S&P’s 44% overall return as we write.

Usually, when a market starts trending hard – like gold – it attracts a massive inflow of investment dollars. Yet we’re still not seeing that happen.

Gold is still one of the most under-owned assets in the world today. And gold tends to lead all other commodities.

For example, silver.

Up until recently, silver was even more unloved than gold. So while gold took off, silver stayed behind, waiting for its time in the sun.

What’s interesting is this is something that tends to happen during gold bull markets. Gold takes off. Then silver catches up and eventually blows past gold when it comes to percent returns.

There’s no reason to think this time will be different. Especially with silver continuing to hit new all-time highs almost daily.

But it’s far more than just gold and silver.

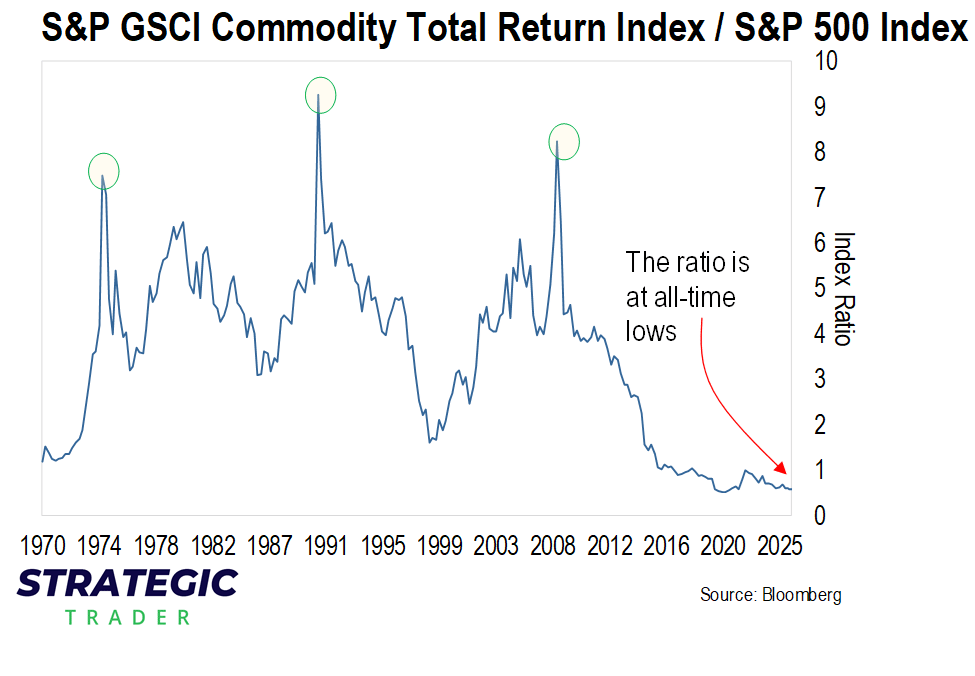

For years, we’ve seen the value of stocks dwarf the value of commodities. Something we can see in the chart below.

The chart shows the ratio of the S&P Commodity Total Return Index to the S&P 500 over the past 50-plus years.

It’s telling us a story.

The lower the ratio, the lower the value of commodities versus stocks. That just means commodities are relatively cheap compared to the broader market.

In fact, commodity valuations today are at a historic low compared to stocks. Even with gold and silver at all-time highs.

At some point, we believe that will change. Investors will flock back into commodities.

And we believe 2026 could mark a major inflection point with commodities. Something that could kick off a new commodities “Super Spike.”

In fact, if you look at the chart again, you’ll see previous Super Spikes circled in green. This next one could be the biggest one yet, as we told premium members in the October issue of Strategic Trader.

Especially if what we predicted with interest rates and the U.S. dollar comes true.

Commodities tend to have an inverse relationship with the dollar. When the dollar is strong, commodities tend to suffer. When it’s weak, commodities tend to gain momentum.

So our prediction for commodities in 2026 is that they’ll head higher.

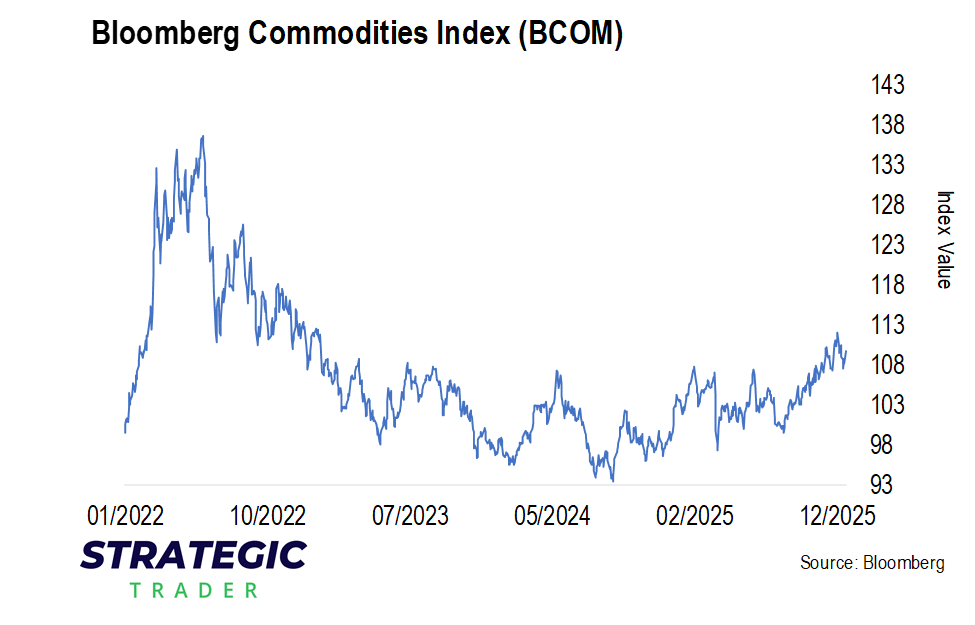

We’ll track this prediction using the Bloomberg Commodities Index (BCOM).

It tracks the prices of a large basket of commodities including precious metals, energy and agriculture.

You name it, we believe commodities in general are set to breakout in the coming year. And even energy will make a comeback that may surprise most investors.

So if you don’t have exposure to commodities in your portfolio, now may be a good time to rethink your allocation.

With three predictions down, we have just one more to go. So be on the lookout for our final article in our prediction series next week.

Regards,

Editor, Strategic Trader