Today, we’ll finish up our 2026 prediction series.

We’ve covered the direction of interest rates, the U.S. dollar and commodities so far in the series.

Remember, making these predictions is one of the most important things we’ll do all year. We don’t care about the exact price. What we want to determine is if these markets will be higher or lower over the next year. That will help us make adjustments to be in a position to outperform.

So far, we said we believe interest rates and the U.S. dollar are heading lower. We’ll track interest rates using the benchmark 10-year U.S. Treasury yield. And we’ll track the direction of the U.S. dollar through the U.S. Dollar Index (DXY).

However, last week we told you that we expect commodities in general to head higher over the coming year. As we told you in that article, gold is leading the way. It’s up 142% over the past three years, while the broader commodities index is lagging far behind, up just 10.5% over the same period.

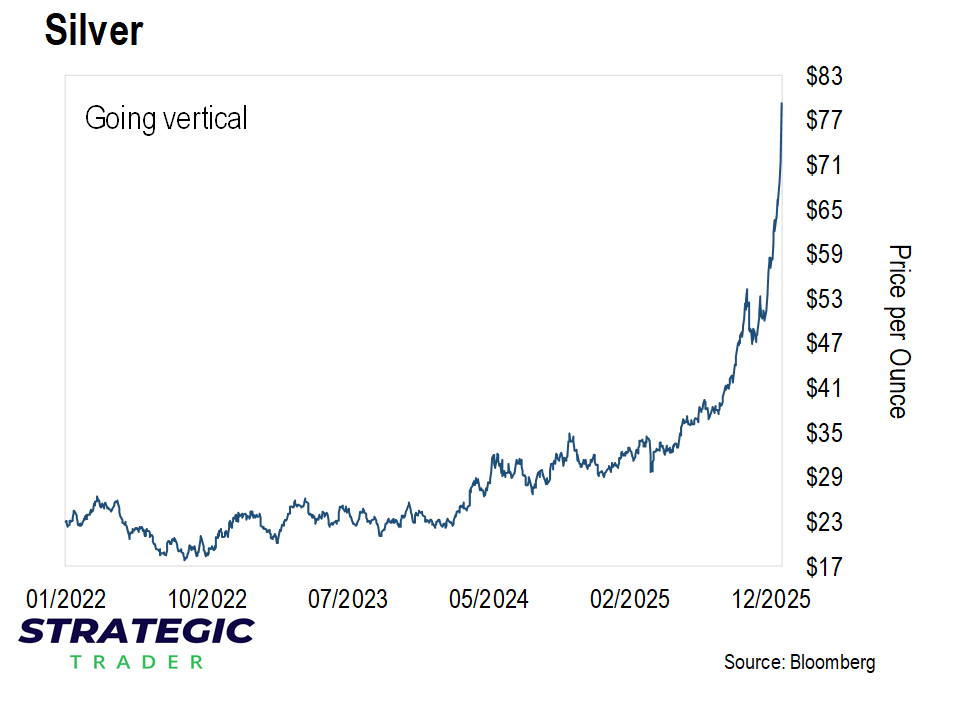

We expect that to change in the coming year. In fact, we think 2026 could mark an inflection point when it comes to commodities. Something we’re already starting to see with silver, which is going vertical.

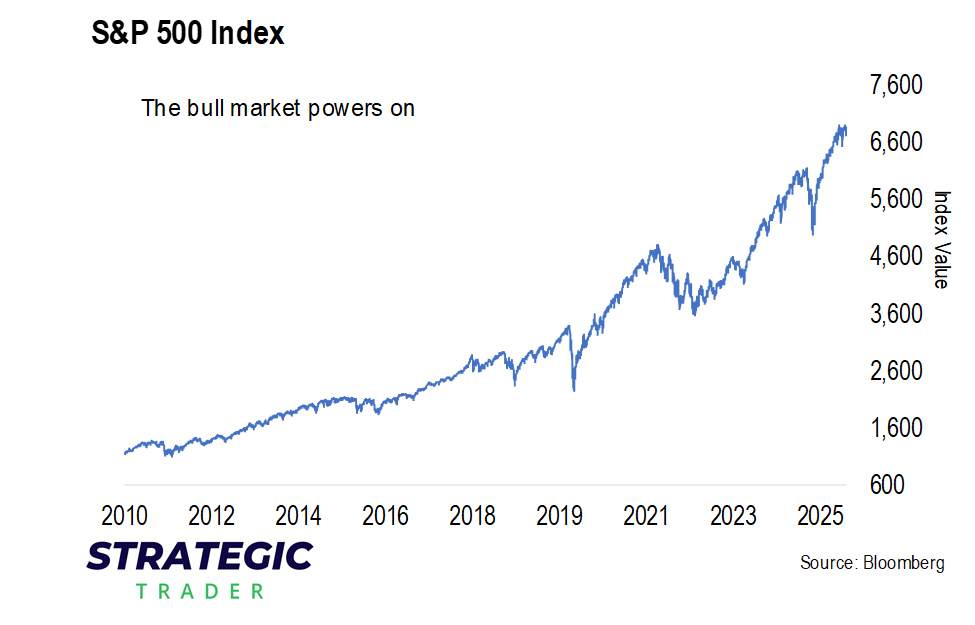

Today, we’ll make our final prediction, putting it all together to see where we think stocks are heading over the next year.

Stocks

The stock market is not going to crash.

We see the potential for a correction…..but not a full-on crash. There are so many factors today affecting stocks that never existed in previous market cycles. In fact, we’re not sure we even have market cycles anymore after more than 16 years of this current bull market.

Yet, it seems like most nonprofessional investors fear a repeat of 2008. We hear it frequently when talking with people. The first thing they tend to do is comment on the market. “It can’t keep going up.” Sure it can.

The total value of the U.S. stock markets is around $70 trillion today. That’s roughly 55% of the world’s approximate $127 trillion in total stock market value.

Plus, the U.S. public market is not as ultra expensive as you would think. We clock a value of around 25-times earnings for the S&P 500 Index today. It’s not cheap. But it’s also not overly excessive. We bet it keeps inching higher.

The question investors don’t know how to ask is what is the index really worth?

A lot of the market today is passive investment funds. These investors don’t know much about the companies that make up the index. They know Nvidia, Amazon, Apple and Microsoft. Since they’re customers they think those are great. At a trillion or more market cap, they never ask how much more can they actually grow.

However, that doesn’t mean a crash is inevitable.

In fact, we’ve said as much in these pages this year, especially when the Federal Reserve started its recent rate-cutting cycle.

In our September 24 article “The Fed’s New Groove”, we showed you what history says about the Fed cutting rates when stocks are near their all-time highs. Over the past 45 years, we’ve had more than 20 instances of the Fed cutting rates with the S&P 500 within 2% of its then all-time high.

In every case, stocks were higher a year later.

Date of Fed Rate Cut | S&P 500 Return After 1-year |

|---|---|

7/25/1980 | 7.6% |

1/11/1983 | 15.2% |

2/28/1983 | 7.6% |

1/15/1985 | 21.9% |

5/20/1985 | 24.5% |

3/7/1986 | 28.9% |

4/21/1986 | 16.9% |

8/26/1986 | 33.2% |

7/31/1989 | 2.6% |

7/13/1990 | 3.5% |

3/8/1991 | 8.1% |

8/6/1991 | 8.8% |

10/31/1991 | 7.4% |

7/2/1992 | 9.0% |

9/4/1992 | 10.6% |

7/6/1995 | 21.4% |

1/31/1996 | 21.5% |

7/31/2019 | 8.9% |

9/18/2019 | 11.6% |

10/30/2019 | 8.6% |

9/18/2024 | 16.3% |

Average Return | 14% |

Source: Carson Investment Research

That’s probably not something you want to bet against. There’s no reason to think that this time will be different.

But it’s more than that.

Take a look at the chart below.

If this were a stock, you’d probably be pretty happy. But it’s not. It’s the amount of money held in money market funds. Meaning cash sitting on the sidelines waiting to pounce.

When interest rates are paying a decent return, investors can park extra money in cash and earn a safe 4% or 5% return. But what happens when that reverses? What happens when all of this money comes off the sidelines?

We already know. All we have to do is look.

In the late 1990’s, there were about $1.3 trillion sitting in money market funds. Then the Fed cut rates. A lot of that money flooded the markets and kicked off the dotcom bubble.

In 2003, there were $2.1 trillion in money market funds when the Fed cut rates. after the dotcom bubble burst. That ignited the housing bubble.

Then after the Great Financial Crisis in 2009, there were $3.8 trillion in money market funds when the Fed cut rates. Everything rallied.

With double the amount of cash today in money market funds as we saw in 2009, what happens when the flow reverses as the Fed continues to cut?

Our guess: stocks are heading higher. Which is what we’re predicting for 2026.

We’ll track this using the S&P 500 Index.

That said, we don’t think this stock market is going to be the same as the past decade. In fact, we think the coming year is exhibiting similar signs of 2003.

After the internet bubble popped, there was an eventual shift in what investors poured money into. The 2003 rally showed investors started favoring real businesses with real profits.

They played a game of musical chairs with growth and internet stocks leading into 2001. At first, there were plenty of chairs. Then all of a sudden, there was nowhere left to sit. So it all crashed to the floor when the music stopped.

When investors plunged back into the market, they waded into the shallow end of the pool. They didn’t want to risk drowning in the deep end with dotcom stocks.

We see a similar setup happening today where there’s an inflection point shifting out of growth at any price and into value in the coming years. Something that lines up with our prediction for commodities since many commodity related stocks are dirt cheap today.

Only time will tell if we’re right. So we’ll check back in a year to see how our predictions panned out.

Until then, we wish you all a very happy, healthy and prosperous New Year!

Regards,

Editor, Strategic Trader